Flourish Cash

A Strategic Solution For Your Cash Managment

Flourish Cash Background: last year as interest rates were starting to rise, we recognized that most banks were not been passing along these higher rates to their customers in their checking and savings accounts. This trend also continued this year as the Fed reversed course and lowered rates to historic lows as a result of the coronavirus – these banks rapidly lowered rates offered on accounts. According to RateWatch, the average APY for savings account at traditional banks hovers at 0.18% today. Banks have historically relied on depositor inertia to retain business and thus have little incentive to materially offer competitive rates that they pay on savings and checking accounts.

As a result, clients frequently ask where they can get higher yields on extra cash being saved for a large upcoming expense or on general emergency savings. In the past, we have tried to find higher yielding money market funds at online banks or through one of our custodians. These solutions are workable but there are often high minimums to get the higher rates, trading and liquidity constraints, and other administrative hassles involved.

Now we have a better solution. It’s called Flourish Cash—a state of the art, cash management solution that is available to clients of 7 Saturdays Financial.

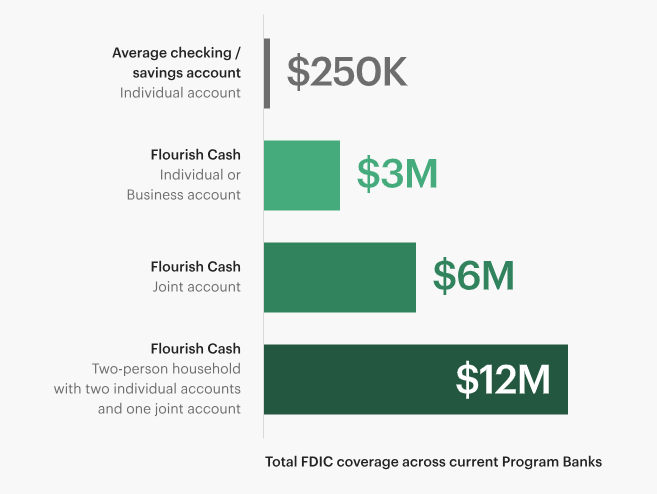

Flourish Cash is an exclusive high-yield savings account that includes daily liquidity and FDIC coverage from two to eight times the normal limit.

Flourish Cash uses one account to accomplish what would otherwise require multiple accounts at different banks. Behind the scenes, cash is automatically transferred to one or more of their FDIC-insured Program Banks that offer competitive rates (banks are willing to pay higher rates because Flourish provides them with significant deposits without the need to spend money on marketing, physical branches, or customer service for those deposits). Because Flourish partners with multiple banks, account holders are eligible to receive higher FDIC insurance coverage than any individual bank account, while receiving one single monthly account statement and one annual tax document. Money deposited with Flourish is not invested in money market funds or other investment products that have a risk of market loss.

FDIC Limit Comparison

Flourish Cash is designed to work alongside an existing bank account for your non-managed cash needs. For example, let’s say you are saving for a home remodel project next year and have parked some money in a Bank of America checking account to pay for it. By connecting the BofA account to Flourish Cash, you can easily move money back and forth, earning the competitive rate offered by Flourish Cash, all while continuing to use your BofA account exactly as you have in the past.

There is no minimum balance requirement to open or maintain an account, and Flourish Cash does not charge any account fees. The rate you see is the rate you get—it is currently 5.00% APY1 — and it will fluctuate both up and down as interest rates change. You get one program rate regardless of which banks have your money. Interest is paid monthly and is generally posted to your Flourish Cash account within the first three days of the following month. Interest payments are deposited with the rest of your funds at Program Banks.

Account holders can access their cash at any time. Flourish doesn’t charge any fees for ACH transfers and only assess a fee if you choose a wire-based transfer to cover their costs. They make money by charging a separate fee directly from their Program Banks based on the deposits they place with them. If you receive an interest payment that puts you over the FDIC limit, it is automatically transferred to your linked bank account instead of your Flourish account. (7 Saturdays Financial also does not charge any fees or receive any compensation for offering this service.)

It is also comforting to know and worth mentioning that Flourish puts an emphasis on cybersecurity protection. They use bank-level encryption and require multi-factor authentication and strong passwords for every client. They also have a dedicated security team that monitors for suspicious activity, send notifications whenever a new external bank is added by a client or a transfer is placed, and prevent withdrawals from new accounts for three days.

A Flourish Cash account is easy to use and set up. Access to the program is by invitation only and initiated upon request to 7 Saturdays Financial at allen@7saturdaysfinancial.com.

1 As of September 11, 2023. Flourish Cash currently has a tiered interest rate structure, as set forth in the rate tier summary. Clients earn 5.00% APY on their first $500,000 in individual and business accounts and their first $1,000,000 in joint accounts, and will earn 4.50% APY on their remaining balances. For current rate information, please click here.

Flourish Cash is a service offered by Flourish Financial LLC, a registered broker-dealer and FINRA member. A Flourish Cash account is a brokerage account offered by Flourish Financial LLC. Flourish Financial LLC is not a bank, but the cash balance in a Flourish Cash account is swept from the brokerage account to deposit account(s) at one or more third-party banks that have agreed to accept deposits from customers of Flourish Financial LLC (“Program Banks”). The accounts at Program Banks pay a variable rate of interest. Clients are responsible for highlighting whether they maintain deposits at a Program Bank outside of Flourish Cash and should consider opting out of having their cash swept to any such Program Bank to avoid exceeding FDIC insurance limits.

For complete program details, including a list of the Program Banks, please visit flourish.com. 7 Saturdays Financial is not affiliated with Flourish Financial LLC. 7 Saturdays Financial does not receive any referral fees or commissions from Flourish Financial LLC.