10 Best Mint Alternatives To Manage Your Money in 2024

0 Comments

/

If managing your money better is one of your New Year's goals,…

How To Teach Kids About Money: 12 Smart Strategies

Parents have a lot of jobs, each as important as the next. But…

How Much Does Health Insurance Cost for Early Retirees?

Early retirement is a great goal, but many overlook one important…

How to Access Retirement Funds Early: 4 Possible Ways

If you retire early, you need a solid personal finance plan to…

3 Best Ways To Build Wealth for High-Earning Engineers

The best ways to build wealth for high-earning engineers aren't…

Understanding your Lockheed Martin 401(k) plan

Whether you’re a new hire or you’ve been with Lockheed Martin for decades, you may have questions about your 401(k). This benefit is a critical element in your retirement planning and it’s essential to understand the nuances of the plan.

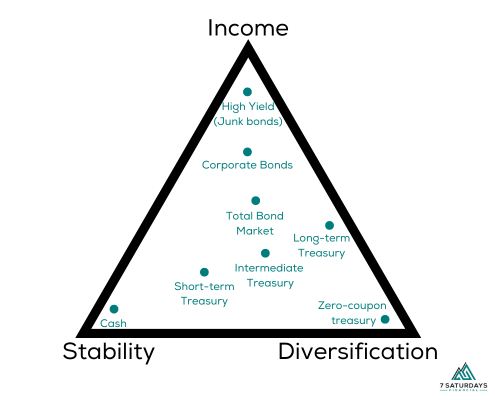

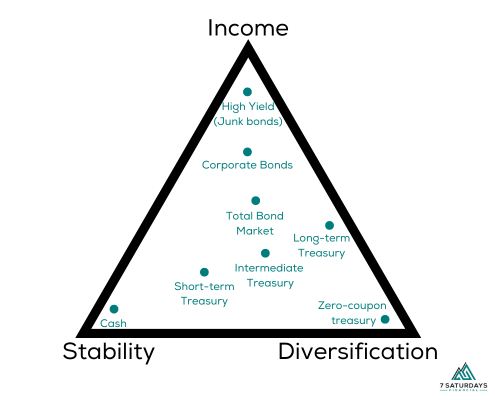

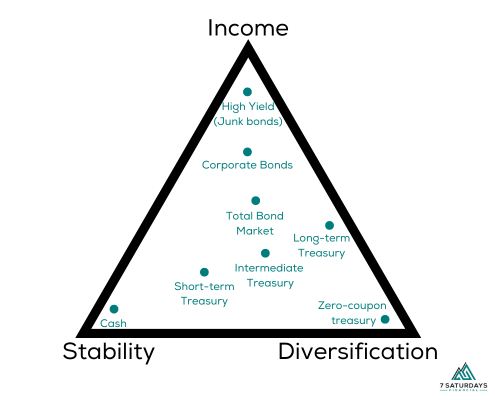

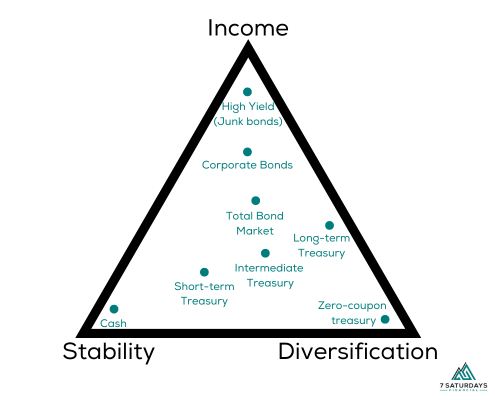

Reader Question: “I lost money on bonds. Should I sell?”

So, you lost money on bonds. The first question to ask yourself is – “Why did I decide that bonds belong in my portfolio in the first place?”

Here Are The Top 3 Raytheon Benefits You May Be Missing

Medical, dental, and vision insurance are standard. So is a 401(k) retirement plan. But there are several other Raytheon benefits that many employees aren’t fully utilizing or aren’t even aware of!

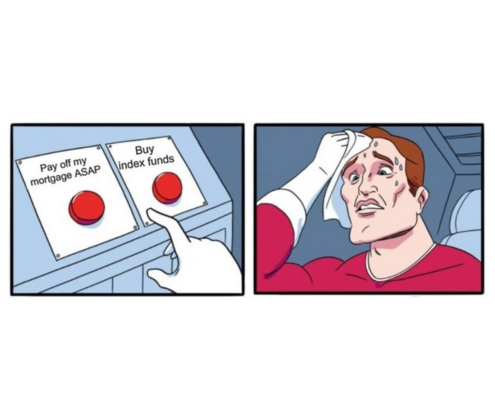

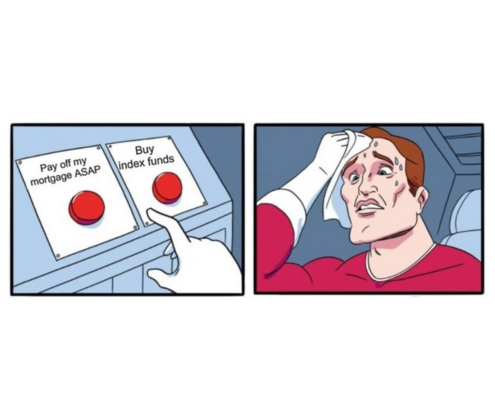

Should You Pay Off Debt Or Invest?

You’ve got extra cash! Maybe it’s from a raise, a bonus, or cutting expenses. Now, you want to improve your financial fitness but aren’t sure whether you should aggressively pay down debt or invest it.

Are I Bonds A Good Investment? (October 2022)

Unless you’ve been living under a rock for the last year, you’ve probably heard of I bonds.

What are they? Are I Bonds a good investment? Should you invest in I Bonds now, or are you late to the party?

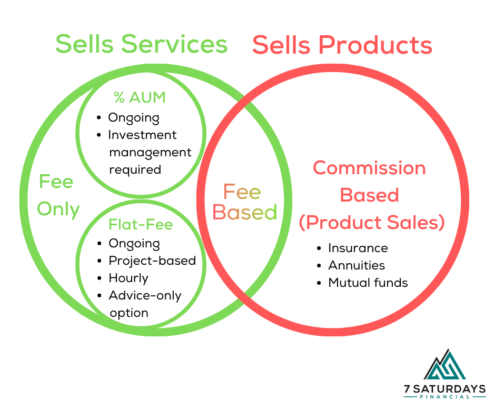

The Advisor Series Part 2: Conflicts of Interest and Other Issues

First - what is a conflict of interest? Investopedia describes it as “A situation in which an entity or individual becomes unreliable because of a clash between personal (or self-serving) interests and professional duties or responsibilities.”

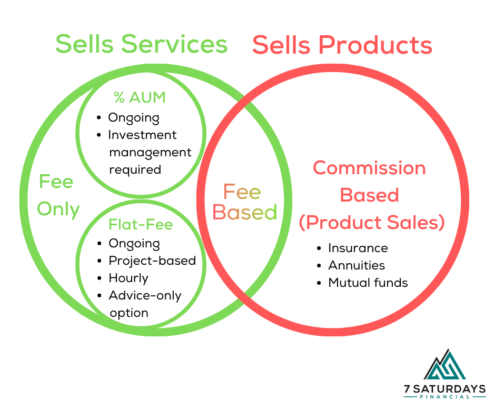

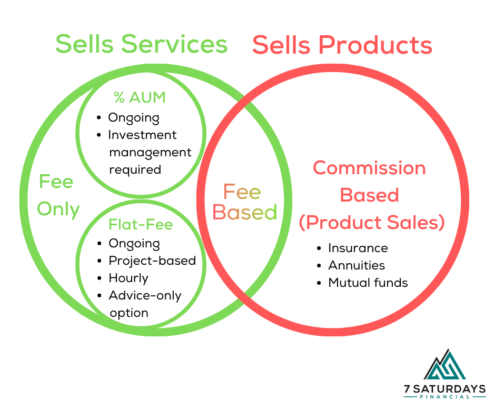

The Advisor Series Part 1: Fee-based, Flat-fee, Fee-only… What the F?

How are you supposed to figure out who to trust with your life savings?

My goal is to shine a light behind the curtain and arm you with information.

This set of articles, “The Advisor Series”, will help you understand the basics of pricing models, typical services provided, issues like conflicts of interest, and questions you should ask when deciding to work with a financial advisor/planner.

Reader Question: “I lost money on bonds. Should I sell?”

So, you lost money on bonds. The first question to ask yourself is – “Why did I decide that bonds belong in my portfolio in the first place?”

Are I Bonds A Good Investment? (October 2022)

Unless you’ve been living under a rock for the last year, you’ve probably heard of I bonds.

What are they? Are I Bonds a good investment? Should you invest in I Bonds now, or are you late to the party?

Should You Pay Off Debt Or Invest?

You’ve got extra cash! Maybe it’s from a raise, a bonus, or cutting expenses. Now, you want to improve your financial fitness but aren’t sure whether you should aggressively pay down debt or invest it.

How Much Does Health Insurance Cost for Early Retirees?

Early retirement is a great goal, but many overlook one important…

Understanding your Lockheed Martin 401(k) plan

Whether you’re a new hire or you’ve been with Lockheed Martin for decades, you may have questions about your 401(k). This benefit is a critical element in your retirement planning and it’s essential to understand the nuances of the plan.

Here Are The Top 3 Raytheon Benefits You May Be Missing

Medical, dental, and vision insurance are standard. So is a 401(k) retirement plan. But there are several other Raytheon benefits that many employees aren’t fully utilizing or aren’t even aware of!

10 Best Mint Alternatives To Manage Your Money in 2024

If managing your money better is one of your New Year's goals,…

How To Teach Kids About Money: 12 Smart Strategies

Parents have a lot of jobs, each as important as the next. But…

How Much Does Health Insurance Cost for Early Retirees?

Early retirement is a great goal, but many overlook one important…

How to Access Retirement Funds Early: 4 Possible Ways

If you retire early, you need a solid personal finance plan to…

3 Best Ways To Build Wealth for High-Earning Engineers

The best ways to build wealth for high-earning engineers aren't…

The Advisor Series Part 2: Conflicts of Interest and Other Issues

First - what is a conflict of interest? Investopedia describes it as “A situation in which an entity or individual becomes unreliable because of a clash between personal (or self-serving) interests and professional duties or responsibilities.”

The Advisor Series Part 1: Fee-based, Flat-fee, Fee-only… What the F?

How are you supposed to figure out who to trust with your life savings?

My goal is to shine a light behind the curtain and arm you with information.

This set of articles, “The Advisor Series”, will help you understand the basics of pricing models, typical services provided, issues like conflicts of interest, and questions you should ask when deciding to work with a financial advisor/planner.

The Advisor Series Part 2: Conflicts of Interest and Other Issues

First - what is a conflict of interest? Investopedia describes it as “A situation in which an entity or individual becomes unreliable because of a clash between personal (or self-serving) interests and professional duties or responsibilities.”

The Advisor Series Part 1: Fee-based, Flat-fee, Fee-only… What the F?

How are you supposed to figure out who to trust with your life savings?

My goal is to shine a light behind the curtain and arm you with information.

This set of articles, “The Advisor Series”, will help you understand the basics of pricing models, typical services provided, issues like conflicts of interest, and questions you should ask when deciding to work with a financial advisor/planner.

How to Access Retirement Funds Early: 4 Possible Ways

If you retire early, you need a solid personal finance plan to…

Reader Question: “I lost money on bonds. Should I sell?”

So, you lost money on bonds. The first question to ask yourself is – “Why did I decide that bonds belong in my portfolio in the first place?”

Should You Pay Off Debt Or Invest?

You’ve got extra cash! Maybe it’s from a raise, a bonus, or cutting expenses. Now, you want to improve your financial fitness but aren’t sure whether you should aggressively pay down debt or invest it.

Are I Bonds A Good Investment? (October 2022)

Unless you’ve been living under a rock for the last year, you’ve probably heard of I bonds.

What are they? Are I Bonds a good investment? Should you invest in I Bonds now, or are you late to the party?

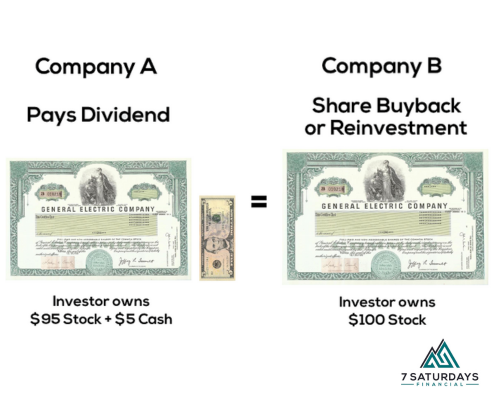

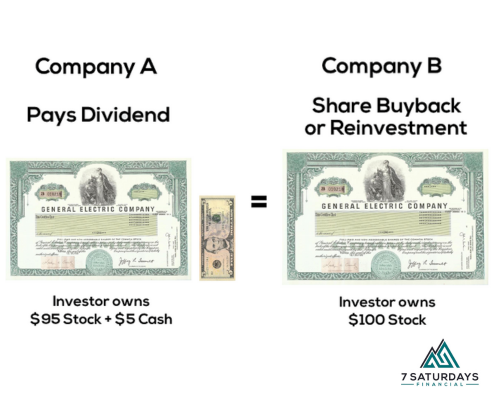

Dividends: Why You Shouldn’t Care About Them

Although dividend investing is popular among investors, that focus can be misguided. It should be considered more of a “feel good” strategy than a good strategy. In this post, I'll explain why dividends are irrelevant.

Reader Question: “I lost money on bonds. Should I sell?”

So, you lost money on bonds. The first question to ask yourself is – “Why did I decide that bonds belong in my portfolio in the first place?”

Dividends: Why You Shouldn’t Care About Them

Although dividend investing is popular among investors, that focus can be misguided. It should be considered more of a “feel good” strategy than a good strategy. In this post, I'll explain why dividends are irrelevant.