Whether you’re a new hire or you’ve been with Lockheed Martin for decades, you may have questions about your 401(k). This benefit is a critical element in your retirement planning and it’s essential to understand the nuances of the plan.

Below are some of the most common questions about the Salaried Savings Plan (SSP).

How much does Lockheed contribute to my 401(k)?

Lockheed Martin contributes to the 401(k) plan in two ways:

- Company contribution of 6% of base pay, regardless of employee contribution

- Company match of 50% on the first 8% you contribute, up to a maximum of 4%

Let’s walk through a couple of scenarios:

- If you contribute $0, you’ll still get the company match of 6%.

- If you contribute 4%, you’ll receive the company match of 6% PLUS 50% of the 4% you contributed, for a total company contribution of 8%.

- If you contribute 8%, you’ll receive the company match of 6% PLUS 50% of the 8% you contributed, for a total company contribution of 10%.

How much can I contribute to my 401(k)?

You can contribute up to 40% of your weekly base pay, up to a 2023 annual maximum of $22,500 between Roth and pre-tax contributions ($30,000 if age 50 or older).

BONUS: The plan also allows after-tax contributions, which can supercharge your retirement savings.

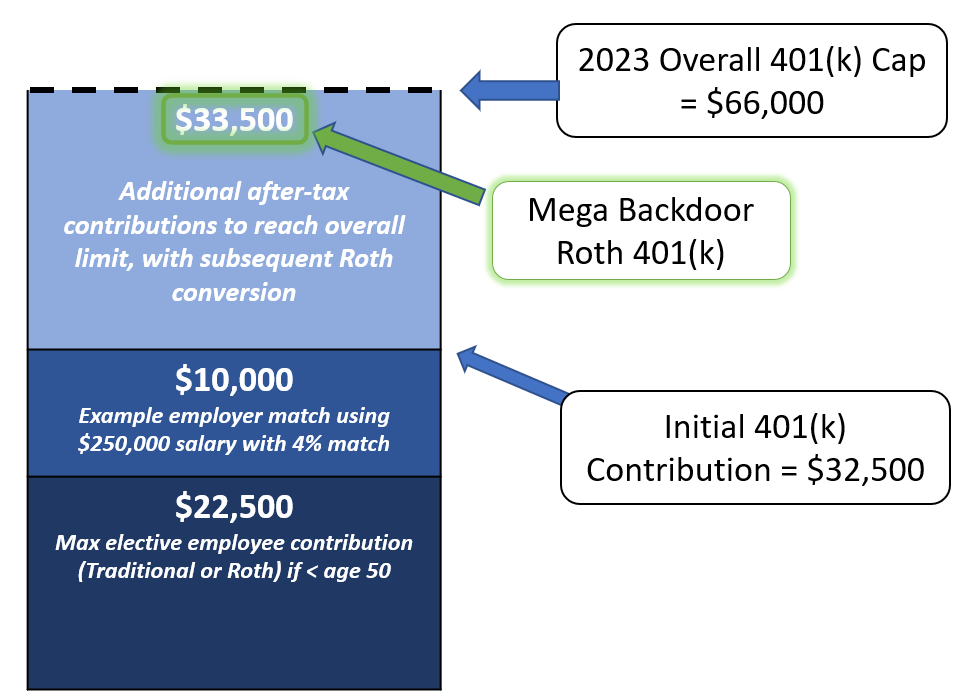

Using after-tax contributions, it’s possible to go above the “normal” 401(k) limit of $22,500 or $30,000 and get up to $66,000 into your account ($73,500 if age 50 or older). This limit includes all employee contributions (pre-tax, Roth, after-tax) and employer contributions.

After you’ve filled up your $22,500 or $30,000 limit between pre-tax and Roth contributions, using after-tax contributions enables you to shovel even more money into tax-advantaged accounts. This maneuver is known as the “Mega Backdoor Roth.”

What is the “Mega Backdoor Roth”?

Below is a graphic showing how the different contributions stack to reach the $66,000 total limit (assuming age < 50):

Here’s what makes the after-tax contributions valuable: they can be converted to Roth within the 401(k) plan. This is a great way to get an extra $20,000 – $30,000+ into a Roth account for tax-free growth and withdrawal (for qualified distributions).

It’s important to note that any earnings accumulated on the after-tax money between contribution and conversion WILL be taxable as ordinary income when converted. Thus, it is best not to let too much time elapse for earnings to build up. The Lockheed plan allows one in-plan Roth conversion per calendar year.

Should I choose Roth 401(k) or Traditional 401(k)?

The choice between Roth or Traditional (pre-tax) contributions is a personal one that depends on your financial situation and goals. Both options offer benefits, and deciding which one is right for you will depend primarily on your current tax bracket versus your expected future tax bracket.

Lockheed Martin’s traditional 401(k) offers an immediate tax break, as contributions are made with pre-tax dollars, lowering your taxable income in the current year. However, when you withdraw the funds in retirement, you will be taxed on the total amount of the distribution. This may be fine if your tax bracket is lower at that time.

There are other issues to consider beyond “tax bracket now vs. at retirement” including Required Minimum Distributions (RMDs) at age 73 or 75, income-based Medicare surcharges (IRMAA), and the potential for tax rates to change in the future.

Having a mix of pre-tax, Roth, and even taxable assets in retirement is a powerful position because you have tremendous control over your tax rate in any given year.

If you’re unsure which option is best for you, consult a flat-fee financial planner for expert guidance.

How much should I be contributing to my 401(k)?

Like many questions in personal finance, the correct answer is “It depends.”

The answer will vary based on factors like your current invested assets, retirement expense needs, other retirement income like Social Security, pensions, or annuities, and when you want to retire.

An employee without a pension who intends to retire at age 50 must save and invest much more than a colleague with a sizeable pension who wants to retire at age 65.

Many financial planning studies suggest that total retirement savings should average around 15-20% of gross income. However, you must run your personalized numbers to ensure you’re saving enough to retire at your desired age with your desired lifestyle.

What can I invest in within my 401(k) plan?

Lockheed Martin offers a range of investment options for its 401(k) plan. Depending on their investment goals and risk tolerance, employees can choose to invest in various asset classes, including stocks, bonds, and cash.

The plan also offers target date funds, which automatically adjust their investments over time, becoming more conservative as the employee approaches retirement.

You may even utilize the self-directed feature inside the Lockheed Martin 401(k), which offers more investment options, including mutual funds.

Can I roll my old 401(k) or IRA into the Lockheed Martin 401(k)?

Yes, the plan allows rollover contributions. Evaluating the account fees and fund costs between your other plan and the Lockheed 401(k) before deciding whether to roll money in is essential.

One benefit of moving an IRA into the 401(k) plan is that once all your pretax IRA money is sheltered inside a 401(k), it opens up the ability to execute the Backdoor Roth IRA. Note that this is different than the Mega Backdoor Roth described above.

When are my contributions and company contributions vested?

You are immediately vested in all contributions to your account and any associated earnings.

How will my Lockheed Martin 401(k) fit with my legacy pension?

If you’re fortunate enough to have a pension, it’s important to understand all your options and how your income sources and assets fit together as part of your retirement income plan.

Frequently Asked Questions about the Lockheed Martin pension plan can be found here.

Where do I go to manage my Lockheed 401(k)?

You can view account balances and make adjustments by navigating to LM People > Pay and Benefits > Savings Plan – Empower. Or, go directly to www.lockheedmartinsavings.com

About the author: Allen Mueller, CFA, MBA, is an “engineer turned finance nerd” and founder of 7 Saturdays Financial. The core focus of his firm is helping Aerospace & Defense employees achieve financial freedom.

Schedule your complimentary intro call today!

Note: this article is general guidance and education, not advice. Consult your money person or your attorney for financial, tax, and legal advice specific to your situation.

Welcome to the 7 Saturdays A Week blog where I share insights on personal finance, investing, and more.