Raytheon Technologies is a Fortune 100 company and, like most large firms, offers a generous benefits package to employees.

Medical, dental, and vision insurance are standard. So is a 401(k) retirement plan. But there are several other Raytheon benefits that many employees aren’t fully utilizing or aren’t even aware of!

Commonly overlooked benefits that can add massive value:

1) Maxing out your Health Savings Account (HSA)

Most people view their health savings account (HSA) as a place to park money for the upcoming year’s medical expenses. But the HSA is a supercharged retirement account in disguise!

It is the only investment vehicle that is triple tax-advantaged: zero tax on contribution, growth, and withdrawal if used for qualified medical expenses. Additionally, HSA contributions funded through payroll deductions avoid employment taxes (Social Security and Medicare). This gives the HSA an advantage over other accounts for long-term wealth building.

Money in your HSA belongs to you and is rolled over year-to-year, unlike a flexible spending account (FSA) which is “use it or lose it.” Most people with HSA’s treat it like a FSA though – they estimate medical costs for the upcoming year and contribute that amount, depleting the HSA as they incur expenses.

This approach is suboptimal.

Ideally, you want to squirrel away as much as possible in this powerful account and invest the surplus for long-term growth. A best practice is to max the account and not withdraw anything until after years or decades of tax-free growth. You can save digital receipts for current-year medical expenses, and reimburse yourself in the future for tax-free income.

HSA money can be withdrawn after age 65 for non-medical purposes and is taxed as ordinary income, just like pre-tax 401(k) or IRA withdrawals.

The maximum HSA contribution for 2023 is $3,850 for an individual and $7,750 for a family. If you’re over age 55, you can invest another $1,000. Be aware these limits include the Raytheon contribution, which varies from $750 to $1,500 depending on how many people are on your plan.

2) Mega Backdoor Roth 401(k)

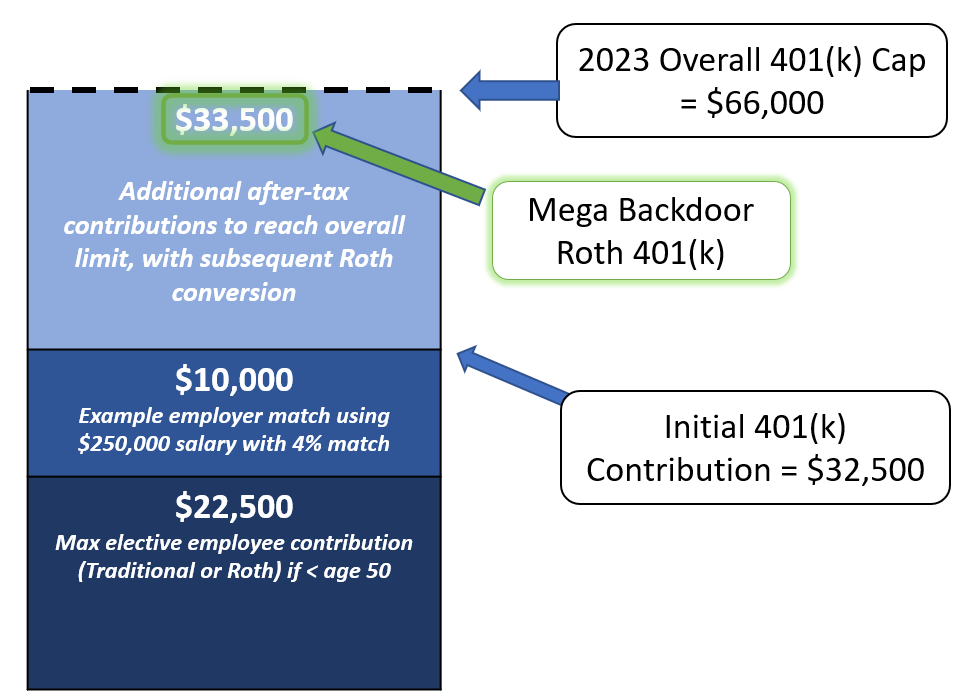

If you’re a high earner, you’re probably maxing out your pre-tax or Roth 401(k) ($22,500 in 2023 if under age 50, $30,000 if 50 or over). Raytheon matches with a contribution of 3-4% of your salary.

Did you know that you can contribute much more than that to your 401(k) – up to $66,000?

The key is after-tax contributions. The RAYSIP plan allows total inflows up to $66,000 per year – including your pretax/Roth contributions, the company match, and any after-tax contributions.

Here’s how the different contribution amounts stack to reach the $66,000 cap:

Once the after-tax contributions are in the account, you can convert them to Roth through Your Gateway or by calling the plan administrator at 1-800-243-8135. The conversion of after-tax contributions is not taxable. This “Mega Backdoor Roth” strategy is an easy method to get money into a Roth account if you’re over the income threshold to contribute directly.

Sheltering money inside a Roth is almost always better than receiving those funds in your paycheck and contributing them to a non-qualified taxable account. Income like dividends and interest in a taxable account is (surprise!) taxable in the year you receive it, and capital gains are taxable in the year they are realized. Roth dollars are never taxed on the income or growth!*

A couple caveats:

- It’s important to note that any earnings accumulated on the after-tax money between contribution and conversion WILL be taxable as ordinary income when converted. Thus, it is best not to let too much time elapse for earnings to build up. I recommend setting a reminder and converting at least semiannually.

- If you contribute too much after-tax too early in the year, it can “squeeze out” the employer match. Your employer has to stay under $66K in total contributions and will reduce the match if necessary. A common practice is to go light on after-tax contributions for Q1-Q3 and then reassess what the contribution needs to be for Q4.

*Roth withdrawals are not taxable if they are qualified distributions.

3) Group Legal Plan

Raytheon offers a group legal plan through MetLife, which covers consultation with an attorney on a variety of matters:

- Family law issues like adoption, custody, name changes

- Financial matters, including debt collection defense and identity theft

- Traffic matters involving ticket defense and misdemeanor defense

- Legal document review

However, the most important benefit for most people is coverage for estate planning which includes creating wills and trusts.

If you don’t have an estate plan, it is crucial to get this taken care of. In the absence of a will, your state decides who gets custody of your children, who makes medical decisions on your behalf, and who gets your assets upon your death. A trust takes estate planning a step further and gives more control over the timing of asset distributions. One use case for a trust is preventing minor children from potentially receiving a large inheritance as soon as they turn 18.

The 2023 cost for MetLife Legal Plan is $12.80 per month. So you can get an entire estate plan in place for around $150 and then cancel the benefit the following year. Compare this to typical attorney fees of $2,000-$3,000 to create these documents, and you can see why the Group Legal Plan is such a tremendous value add!

Conclusion

Raytheon employee benefits are a significant component in your total compensation package.

Make sure you’re taking advantage of all of the Raytheon benefits available. If you have a financial advisor, they should be reviewing your benefits annually to help you make decisions that align with your values and goals.

7 Saturdays Financial specializes in helping Aerospace & Defense professionals achieve financial freedom. Schedule your complimentary intro call today!

Welcome to the 7 Saturdays A Week blog where I share insights on personal finance, investing, and more.