Financial Services is a difficult industry for the average person to understand.

Simple concepts are overcomplicated and cloaked in jargon. Fees are often buried in product commissions or aren’t clearly communicated. Conflicts of interest are rarely disclosed.

Financial Advisors (or Financial Planners, or Wealth Managers, or Investment Advisors – what’s the difference?) usually have a string of letters after their name. What do all these credentials mean? Are they working in my best interest or their firm’s?

How are you supposed to figure out who to trust with your life savings?

My goal is to shine a light behind the curtain and arm you with information.

This set of articles, “The Advisor Series”, will help you understand the basics of pricing models, typical services provided, issues like conflicts of interest, and questions you should ask when deciding to work with a financial advisor/planner.

Part 1 starts the series by exploring the standard pricing models and the typical services each arrangement provides.

So let’s dive in!

Part 1: Fee Models

One of the most misunderstood aspects of personal finance is the advisor’s pricing model.

Although it seems like a minor detail, how the advisor is compensated is essential – it introduces conflicts of interest into the equation which can bias advice, and it also determines how much of your hard-earned money you’ll part with. Unfortunately for the clients, this can vary widely.

Choosing Advisor A can cost 5-10x for the same service as Advisor B in many situations!

A Brief History of Advisor Pricing Models

Until about 50 years ago, advisors made their living primarily through commissions from product sales and trading fees. This often led to advisors prioritizing the mutual funds that paid them the highest commissions rather than what was best for the client. It also incentivized excessive trading (churning) in investment accounts to drive up the per-trade revenues.

At that time, the advisors were essentially salespeople and the conversations often started with products – specific mutual funds or insurance schemes – rather than questions about the client’s situation and goals.

Imagine going to the doctor’s office and, before asking a single question about your symptoms, he hands you a prescription!

A new model started gaining popularity during the ’80s and ‘90s – Assets Under Management (AUM). Under the AUM model, clients pay advisors directly rather than the advisors receiving commissions from their firms for product sales.

Fees are quoted as a percentage of the managed portfolio size (1%, for example). Charging customers directly was a huge step in the right direction for transparency and reducing conflicts of interest.

Currently, about 90% of firms use the AUM model for at least a portion of their fees, with many firms choosing to receive commissions from product sales (mutual funds, annuities, insurance) as well.

New pricing models such as Flat-fee have entered the market in recent years, and are proliferating due to consumer demand. These alternative models are a natural evolution of the business and they offer many advantages for clients compared to legacy fee structures.

Categories of Fee Models

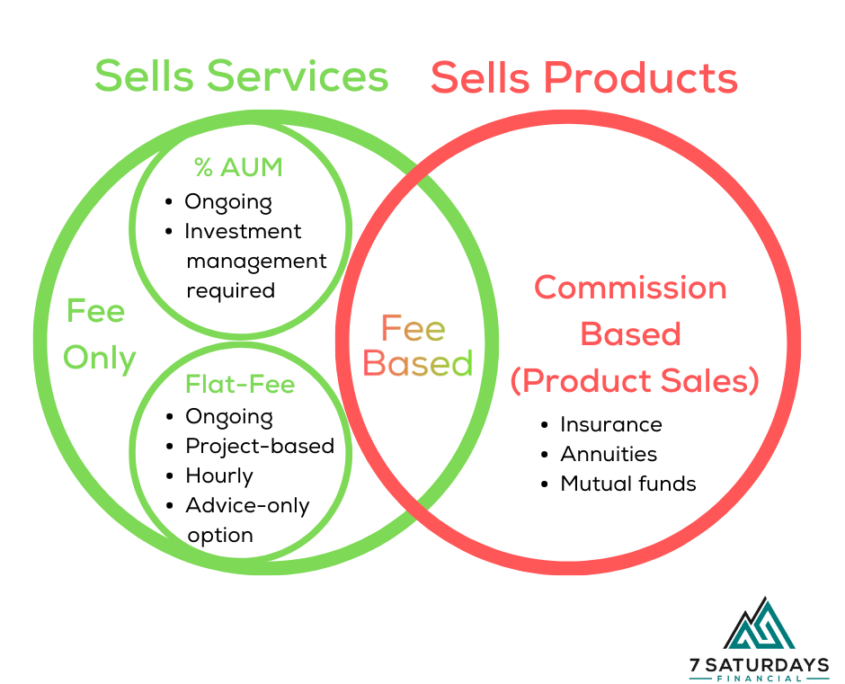

When describing the different pricing models, I like to separate everything into two categories:

- Those who receive commissions on product sales: Commission-based

- Those who are paid directly from the clients: Fee-only

You may have heard the term “Fee-based”, but it is not the same as #2.

“Fee-based” is a marketing term that product salespeople likely introduced to make it sound like they only are paid through fees. It’s actually a hybrid model that compensates the advisor through fees AND commissions. They can be paid with either (or both) depending on the product/service being offered.

Before we go any further, let’s introduce a visual aid to help you understand how everything fits together.

Notice everything on the right side is Commissions, the left side is Fee-only, and the overlap in the middle is Fee-based (paid through product commissions and fees).

Now that we’ve got a high-level understanding let’s dive in a bit deeper into the two primary models and typical services provided.

Commission-based Models

A commission-based advisor (salesperson) gets paid based on products they sell. They may pitch themselves as “free” to the client but make no mistake – they are paid through the fees or costs baked into the product.

Selling a whole life insurance policy can earn thousands of dollars in commissions, and selling a front-loaded mutual fund can earn 5% or more of the initial investment. Advisors operating under commissions typically offer minimal financial planning to ultimately sell a product.

Think of a car salesman asking you about your family size, how much driving you do, etc. The end goal is to sell you a product that may or may not be the best fit for you – they’re certainly not going to direct you to another dealership if that happens to be a better option. Ongoing guidance is uncommon with commissioned sales, because there’s no incentive to continue providing advice after the transaction.

Pretty straightforward, right? Let’s move on to the Fee-only side.

Fee-only Models

An advisor who is “Fee-only,” receives no sales commissions and is compensated only from clients directly. Fee-only is often confused with Flat-fee, but Flat-fee is a specific subset of the Fee-only category.

The two branches of the Fee-only category are Assets under Management and Flat-fee. The difference is in how the fees are calculated.

1) Assets Under Management (AUM)

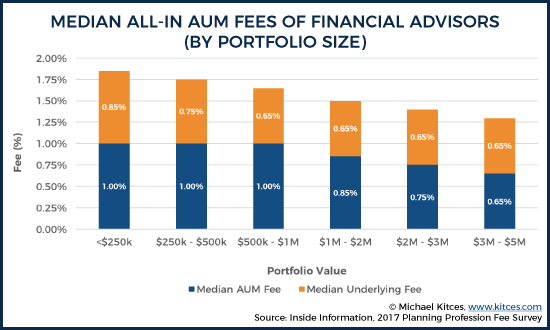

For advisors using the AUM model, the price depends on the size of the managed portfolio. 1% is a typical figure and many firms offer a tiered model with discounts at certain levels (first $1M at 1%, next $1M at 0.75%, etc.)

A 1% AUM fee on a $1 million portfolio would cost $10,000 per year, rising over time with the portfolio’s growth. Investment management was historically the only service provided (with planning available for an additional cost), but now many firms include financial planning in their AUM fee.

Fees are deducted straight from client accounts which makes it is a “frictionless” transaction compared to paying with a check or credit card. Many families have no idea how much (in dollars) they’re actually paying their advisor because they haven’t multiplied the AUM percentage times their portfolio size!

Pro Tip: The AUM fee is usually in addition to the fund fees in the investment portfolio (often 0.5% or more), so be sure to add the two together to understand what you’re paying in total.

Kitces.com studies have benchmarked the average “all-in” fee for < $1M to be at least 1.65% (see image below). This would cost $8,250 annually for a $500K portfolio. If the advisor offers a “wrap fee” program, this includes the AUM fee and trading costs but typically excludes fund expense ratios.

2) Flat-fee

Under the Flat-fee model, price depends on the service provided rather than the portfolio size – clients pay a flat dollar amount whether they have $50K of investable assets or $5M.

Comprehensive financial planning is the core focus of most Flat-fee firms, and this covers a broad scope of topics including retirement planning, tax-efficient accumulation/distribution strategies, investments, education funding, charitable giving, estate planning, employee benefits, etc.

Advice-only is a great option for clients who have the time, talent, and temperament to manage their investments but still want guidance on how to allocate their accounts and have a professional look at the rest of the planning areas. Advice is either one-time (project-based/hourly) or ongoing. Price ranges vary, but one-time projects usually cost $1,000-$6,000 depending on scope, and ongoing is in the $5,000-$10,000 per year range.

Clients who would rather have their investment accounts managed can pick a Flat-fee advisor who offers this service. Most will start the process with a comprehensive financial plan and offer investment management as part of the ongoing planning process or as a separate add-on fee.

Conclusion

Understanding how an advisor gets paid can be one of the most confusing aspects of finding a financial professional, but at a high level, remember these four points:

- Fee-based advisors also receive commissions from product sales.

- The cost for Commission-based advisors depends on products they sell.

- The cost for AUM advisors depends on the size of your portfolio.

- The cost for Flat-fee advisors depends on the services they provide.

Check out Part 2 of the Advisor Series, where I cover the real juicy stuff – conflicts of interest and other issues unique to each fee model!

7 Saturdays Financial is proud to be a flat-fee firm that receives no sales commissions.

Welcome to the 7 Saturdays A Week blog where I share insights on personal finance, investing, and more.