Thanks for the question, David! Here’s the full text –

“I lost money on bonds, should I liquidate or hold the course? Investments are in an IRA so cannot write off the losses.“

Answer

The first question to ask yourself is – “Why did I decide that bonds belong in my portfolio in the first place?”

Has that reason changed?

If an asset is part of your financial plan, recent performance shouldn’t affect your decisions. There will often be times when part of your portfolio is losing money.

This is normal and doesn’t necessarily mean it was a wrong decision to own those assets. An efficient portfolio is designed to work as a system – certain segments balance out the risks of others. Diversification and rebalancing are key for keeping risk in line, and performance should be evaluated as a whole over multiple years.

Abandoning a long-term investment strategy because of recent losses is like closing the barn door after all the cows have run away!

While bonds aren’t as volatile as stocks, they can have moderate swings in a short period as we saw in 2022. To help you better understand the fixed-income asset class, I’ll cover some fundamentals:

First, you can expect riskier (more volatile) investments to generate higher returns than lower-risk investments. This is why stocks have higher expected returns than bonds, and bonds have higher expected returns than cash.

Next, let’s talk about the two main types of bond risk: duration and credit.

Interest Rate Risk (Duration)

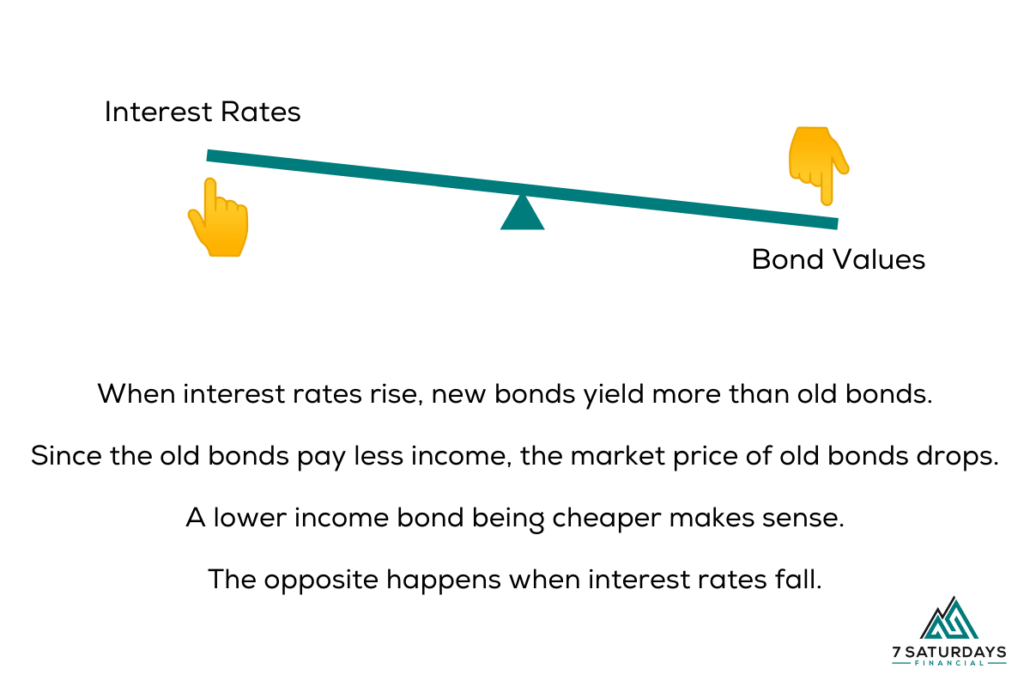

Interest rates and bond values move in opposite directions so when interest rates go up, bonds fall in value and vice versa.

This asset class got slammed last year because the Federal Reserve raised interest rates seven times. There’s a silver lining to interest rate increases, though – new bonds are paying higher income (yield).

In the case of bond funds, new bonds that enter the fund to replace older ones will generate higher yields. This higher income will, over time, offset the value lost from the interest rate increases.

The number of years it takes for the effects of interest rate increases (value decrease + yield increase) to neutralize each other is approximately equal to the fund’s duration. This is a gauge of interest rate sensitivity and is a common measure to use when comparing bonds. High-duration funds hold longer-term bonds and will be more sensitive to rate changes compared to short-duration funds.

Since we know bond prices move the opposite direction of interest rates, it prompts an interesting question:

If I know interest rates will increase, should I avoid bonds or switch to short-term/short-duration?

It’s a logical train of thought.

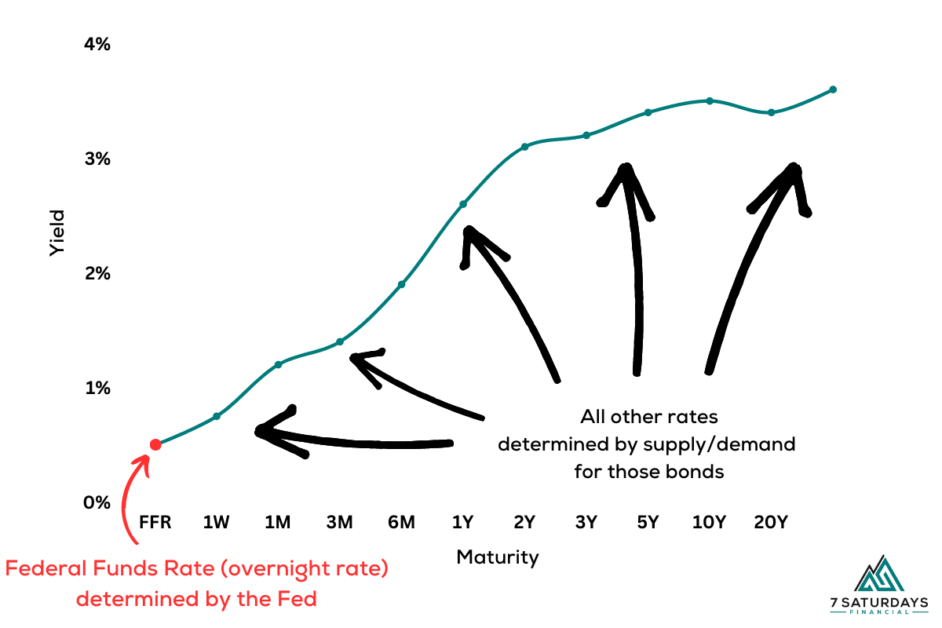

However, even if we “know” (think) the Federal Reserve is going to increase rates, their adjustments only directly affect the overnight lending rate.

The Fed doesn’t go down the list of different bond maturities and physically adjust the 1-year rate, the 5-year rate, the 10-year rate, etc. These other rates are based on the market prices for the bonds which are set by market forces of supply and demand.

And just like any market, it’s hard to predict exactly what will happen. Expectations about the economy, inflation, and future interest rate increases are already baked in to market prices!

An example of market dynamics: If 10 year bonds are desirable, more people will be buying than selling which drives up the price. This price increase reduces the yield. When the yield gets to a point that the market no longer finds attractive, buyers stop buying and equilibrium is reached.

Overnight Rate: Fed -> Rate

Other Rates: Market -> Price -> Yield (rate)

Overnight rates are directly impacted by Fed rate adjustments. Very short-term bonds like T-bills (maturing in less than 52 weeks) will be somewhat sensitive to rate adjustments. But for longer maturities, it’s anyone’s guess and there are about a gazillion things that affect market dynamics.

Imagine grabbing the end of a 25-foot rope that is stretched out on the ground. If you swing your arm up, the rope closest to your hand will experience the greatest movement but the other end of the rope will move little, if at all.

This is a good metaphor for interest rate dynamics – the overnight rate is directly affected, very short-term bonds are somewhat affected, and longer-term bonds move much less predictably.

Credit Risk

The other risk factor for bonds is credit risk – the possibility you may not receive the interest or principal you’re promised.

Treasuries (government bonds) are considered to be zero credit risk because the government can simply tax its way out of budget challenges. Corporations don’t have that same ability – they can go bankrupt and default on their debt.

The less stable a company is, the higher the risk of default, and the lower its bond values. Remember, lower value means higher yields! Low quality corporates are also called “junk bonds” or “high yield.”

Now, back to why you chose to hold bonds in your portfolio…

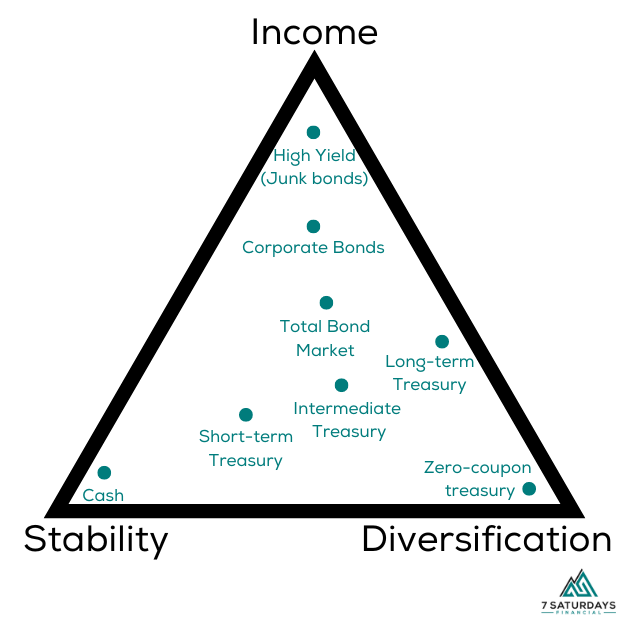

It’s important to understand that fixed-income assets can provide varying degrees of stability, diversification, and/or income depending on the type that are selected.

Stability

- Short-term bonds are more stable and less sensitive to interest rates than long-term bonds.

Diversification

- Treasuries are a better diversifier for a stock-heavy portfolio than corporate bonds because treasuries are free of credit risk.

- There is usually a flight to safety during economic downturns, and this often causes treasury prices to rise while stocks are falling. This effect stabilizes the overall portfolio and reduces volatility.

- Corporate bond values get dragged down during recessions (due to credit risk) and fail to provide diversification when it is needed the most!

- Long-term treasuries are considered to be better diversifiers than short-term treasuries.

Income

- Short-term bonds are less risky (duration) than long-term bonds so they pay lower yields.

- Treasuries are less risky (credit) than corporate bonds so they pay lower yields.

- High-yield corporates (junk bonds) are riskier than other corporates and generate higher income.

As you can see, there is no free lunch.

If you want more stability, you’re giving up some diversification and income.

If you want more income, you’re giving up some stability and diversification.

Putting it all together:

It can be alarming when you lose money on a “safe” asset like bonds, but it’s always important to keep a long term view.

- Is your plan still on track?

- Have you rebalanced to manage risk?

- Is your portfolio designed to work as a system or is it a hodgepodge collection of assets you threw together?

Don’t look at the bond portion of your portfolio in isolation – think about your asset mix (stocks/bonds/alternatives/cash) as a whole and the role(s) you want bonds to play. Choose the appropriate type for this objective.

A suitable portfolio balances risk with return and aligns with your goals, timeline, and risk tolerance.

Book a free consultation if you’d like help creating a financial plan and designing an investment portfolio that is right for you!

Welcome to the 7 Saturdays A Week blog where I share insights on personal finance, investing, and more.