Part 1 of The Advisor Series laid the foundation for understanding the basics of advisory fee and service models.

Part 2 builds on that foundation and explores issues like advisor conflicts of interest, cost vs. value, and other considerations for each fee structure.

First – what is a conflict of interest?

Investopedia describes it as “A situation in which an entity or individual becomes unreliable because of a clash between personal (or self-serving) interests and professional duties or responsibilities.”

Let’s explore the different fee models with this lens.

Commission and Fee-based Models

A commissioned advisor earns income by selling insurance products (often marketed as investments), annuities, or mutual funds. The salesperson receives a commission from the company whose products they sold, and the amount of income depends on the specific policy or fund.

Recall from Part 1 that “Fee-based” is a meaningless marketing term as clients can pay the advisor directly OR the advisor can earn sales commissions.

Conflicts of Interest with Sales Commissions

The obvious conflict of a salesperson’s role is that no sale = no income. The advisor will be very motivated for you to buy from them and may even create a “financial plan” that demonstrates their products are the solution to your problems.

Let’s be clear – there’s nothing inherently wrong with a salesperson earning a commission. And sometimes, annuities and insurance policies can be exactly what the client needs (avoid the mutual funds loaded with sales fees, though).

But we’re kidding ourselves if we pretend there isn’t a massive conflict of interest when a salesperson who makes a commission is telling you their product is the BEST possible option for your situation. Red flag if they can only sell products from their company rather than shopping for the best deal in the overall marketplace.

Imagine saying, “Hey Toyota salesman! Do you think this base model Highlander is suitable, or should I buy the more expensive one? Maybe a Lexus? Or would a Honda Pilot better fit my needs and budget?”

Are they likely to recommend a product that provides them a lower or a higher commission? Or no commission at all if you don’t buy from them? How do you know if a specific recommendation is made based on your interests or their interests?

You don’t.

For this reason, it’s best to separate the recommendation from the actual sale.

A fee-only advisor can recommend a specific product and refer you to a trusted broker who shops with multiple companies for implementation.

Other Issues with Commissions

If you’re looking for ongoing financial planning or investment management, buying a product will not satisfy your needs. The person who sold the product has no incentive to provide continuing support beyond directing you to more products.

For ongoing advice, you’ll need to pay an ongoing fee. This is an excellent segue into the Fee-only models: AUM and Flat-fee.

Assets Under Management (AUM)

Assets Under Management (AUM) is the most common fee structure today.

Under this model, the client pays the advisor directly rather than the advisor receiving kickbacks on product sales. The fee is determined based on the client’s portfolio size (i.e., 1% of assets) and is billed directly from managed accounts.

Conflicts of Interest with AUM

Your advisor’s income is directly tied to the size of your portfolio. This should align your interests with their interests, right? The higher your return, the more money the advisor makes.

The hair in the soup is that advisors don’t produce returns – financial markets do.

The value of financial planning goes far beyond picking investments and it’s so incredibly difficult to “beat the market” with stock picking/market timing that almost all fund managers on Wall Street fail over the long term. So what are the odds Chad at the local broker’s office is the next Warren Buffet with a secret method to outguess the market? Not likely.

An advisor’s job is not to generate the highest return possible, but to develop an asset allocation (mix of stocks/bonds/alternatives) that is appropriate for YOUR situation and goals. For example, the best portfolio for you may have a slightly lower expected return with significantly lower volatility. A more stable allocation often means a higher probability of long-term success, especially approaching or in retirement.

When a professional provides advice and is compensated based on the size of your portfolio, it introduces perverse incentives into the relationship. Think about questions like:

- Should I pay off my home?

- Should I increase contributions to my 401(k)?

- Can I afford to gift to family/charity?

- Is an annuity appropriate for me?

- Can I afford to retire yet?

- Should I do Roth conversions?

- Should I consider investing in real estate?

- Should I take on less risk in my portfolio?

If an advisor answers “yes” to any of these questions, it means a smaller portfolio and a smaller paycheck. I’m sure there are many professionals who would not be swayed by this incentive, but it introduces a conflict of interest that the CFP® Board has specifically called out as “material.”

Surprisingly, it’s rare for firms to disclose this conflict to clients or prospective clients!

Other Issues With AUM

- Mandatory Management – The AUM model requires moving investments to the firm’s preferred custodian – no “advice only” option for those who are comfortable managing their own portfolio. Many firms will not advise on “held away” assets like 401(k)’s, real estate, or cryptocurrency.

- Asset Minimums – Most firms have asset minimums and won’t work with clients who don’t meet their wealth threshold.

- Arbitrary Fee Calculation – Portfolio size is a poor gauge of how complex a client’s situation is, and the AUM model implies that the principal value of an advisor is picking investments (rather than financial planning.) Managing a $2 million portfolio doesn’t require 10x the time or expertise versus one that is $200,000. Why does it cost 10x as much? Is the owner of the $2 million portfolio receiving service equal to $20,000 per year? I sure hope so!

- Market Fluctuations – A bull market can mean 30% gains in a year, and a bear market can cause similar losses. Is the advisor’s value directly linked with the economy? A downturn means the advisor is taking a pay cut. Should they be out hustling for new business to make up for the loss of income, or is it better if they’re focusing on planning opportunities for current clients like tax loss harvesting, Roth conversions, etc.?

- Rapid Fee Growth – Managing a $500,000 portfolio at 1% would cost $5,000 this year. If the investments grow at 8% on average, then the fee also rises 8% annually. Talk about inflation! Any other household expense growing at that rate would be a lightning rod. The unfortunate truth is that service stays relatively flat but the cost snowballs over time.

- Retirement Income Impairment – Fees are often absurdly high relative to the service provided. During retirement, advisory fees can consume 1/4 of a portfolio’s pretax income (assuming a 4% withdrawal rate and a 1% AUM fee). The effect is living on substantially less in retirement or working longer and amassing a 33% larger portfolio to cover the management expenses.

Flat-Fee

The flat-fee model is a modern pricing structure that challenges the status quo of asset-based pricing and commissioned sales.

Price is determined by the service provided, rather than the portfolio size or products sold. Advisors are free to give unbiased advice without compensation incentives tilting their recommendations. Thus, this model reduces client/advisor conflicts of interest.

Flat-fee firms typically offer various services – ongoing advice with optional investment management as well as limited engagements through project-based or hourly work.

Conflicts of Interest with Flat-Fee

It’s challenging to imagine conflicts of interest that are unique to this pricing model. However, you could point to conflicts in any business transaction- the buyer wants to pay less, and the seller wants to charge more.

Similarly, firms that offer hourly work could be incentivized to overstate their hours and collect more revenue. It is unlikely that either of these potential conflicts would bias the advice given to clients.

Other Issues with Flat-Fee

The flat-fee model can be more expensive than AUM early in an investor’s journey. For example, a family with $250,000 of assets would pay $2,500 for the first year under 1% AUM (if they meet the asset minimum). Similarly, a flat-fee planner could charge $4,000 – $6,000 for a year of service. It’s important to point out that AUM fees often only include investment management, whereas flat-fee service usually has a broader scope (including planning).

Additionally, flat-fee doesn’t mean “fixed-fee”. It’s reasonable to expect a firm to raise prices over time as the cost of living and business expenses rise. However, the fee increases will almost always pale in comparison to how quickly the AUM fees grow over time.

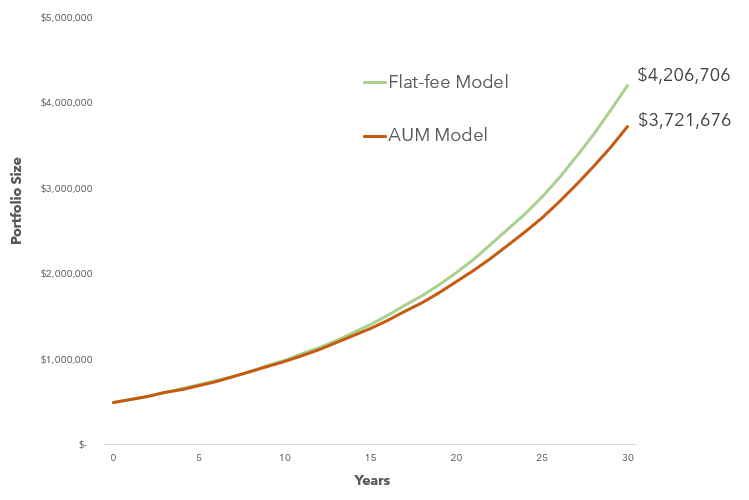

Below is a comparison of how a 1% AUM fee and a flat-fee impact a $500,000 portfolio over time. Both start at the same dollar value, but the AUM fee grows with the portfolio at 8% annually, whereas the flat-fee increases at the inflation rate (3%).

The difference in ending account value over 30 years is staggering – almost $500,000, which was the initial investment!

If you assume retirement at the end of the timeline using the 4% rule, the flat-fee investor would have $155,000 of annual pretax income after fees, and the AUM investor would receive $111,000 – a 28% decrease. A smaller retirement portfolio and a higher advisor fee through retirement explain the difference in income.

Conclusion

No fee model is perfect, but obviously some are better at protecting the client’s interests (and wealth!) than others.

Considering the conflicts of interest and the issues described above, I recommend investors narrow their search to only flat-fee advisors.

7 Saturdays Financial is proud to be a flat-fee firm that receives no sales commissions.

Part 3 of the Advisor Series will cover questions to ask as you interview advisors and key attributes to look for. Stay tuned!

Welcome to the 7 Saturdays A Week blog where I share insights on personal finance, investing, and more.